Alternative Data for Yelp

About Yelp

Yelp Inc is a provider of online platforms to connect buyers and sellers. It generates revenue by selling advertising space to businesses mainly in the United States.

| Price | $27.31 |

| Target Price | Sign up |

| Volume | 1,400,000 |

| Market Cap | $1.78B |

| Year Range | $27.31 - $38.76 |

| Dividend Yield | 0% |

| PE Ratio | 12.62 |

| Analyst Rating | 33% buy |

| Industry | Online Media |

In the news

|

Louisville's MeeshMeesh Mediterranean cracks Yelp’s top 100 restaurants listJanuary 26 - WDRB |

|

Yelp's 'Top 100 Places to Eat' in U.S. 2026 names 4 South Florida spotsJanuary 23 - Sun Sentinel |

|

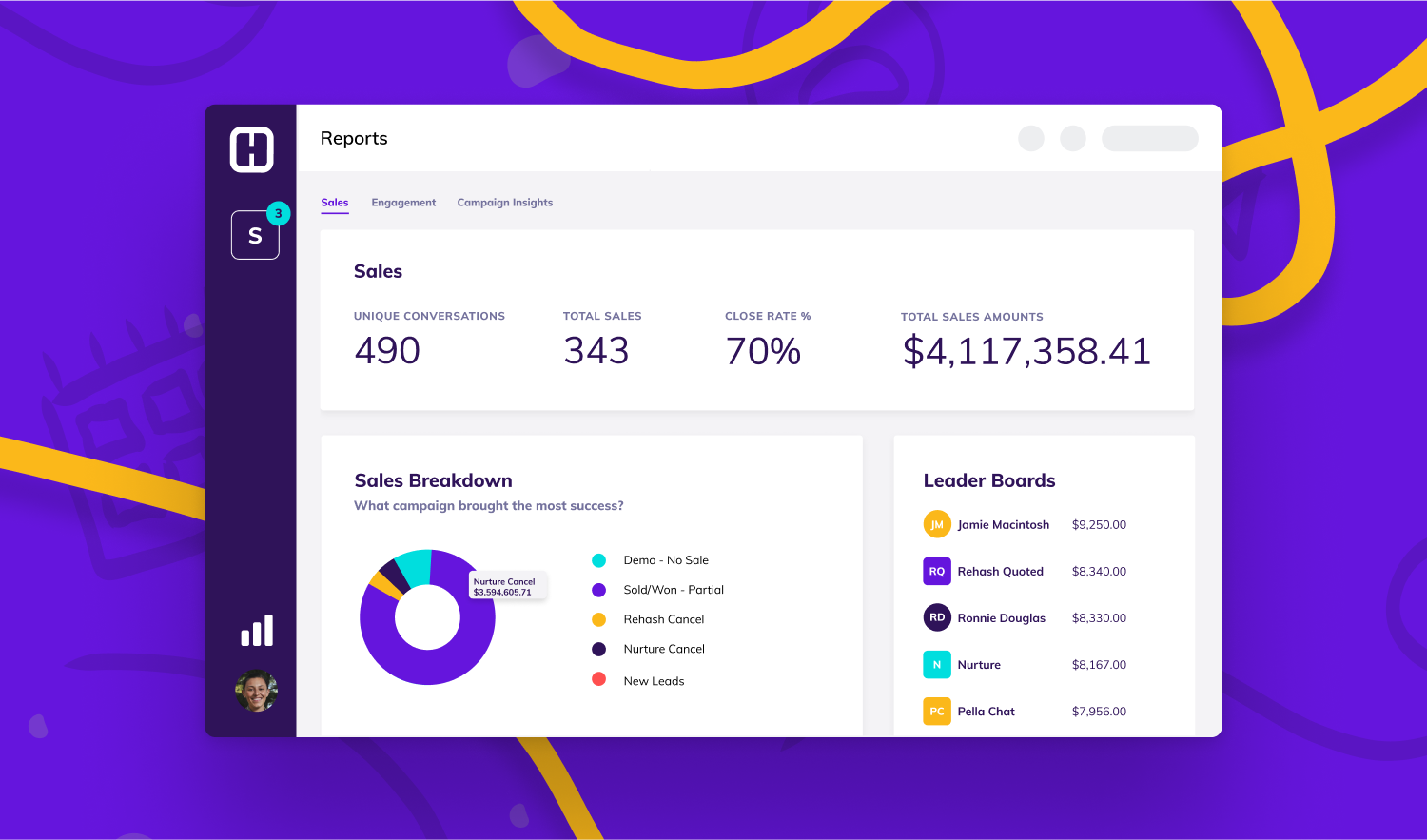

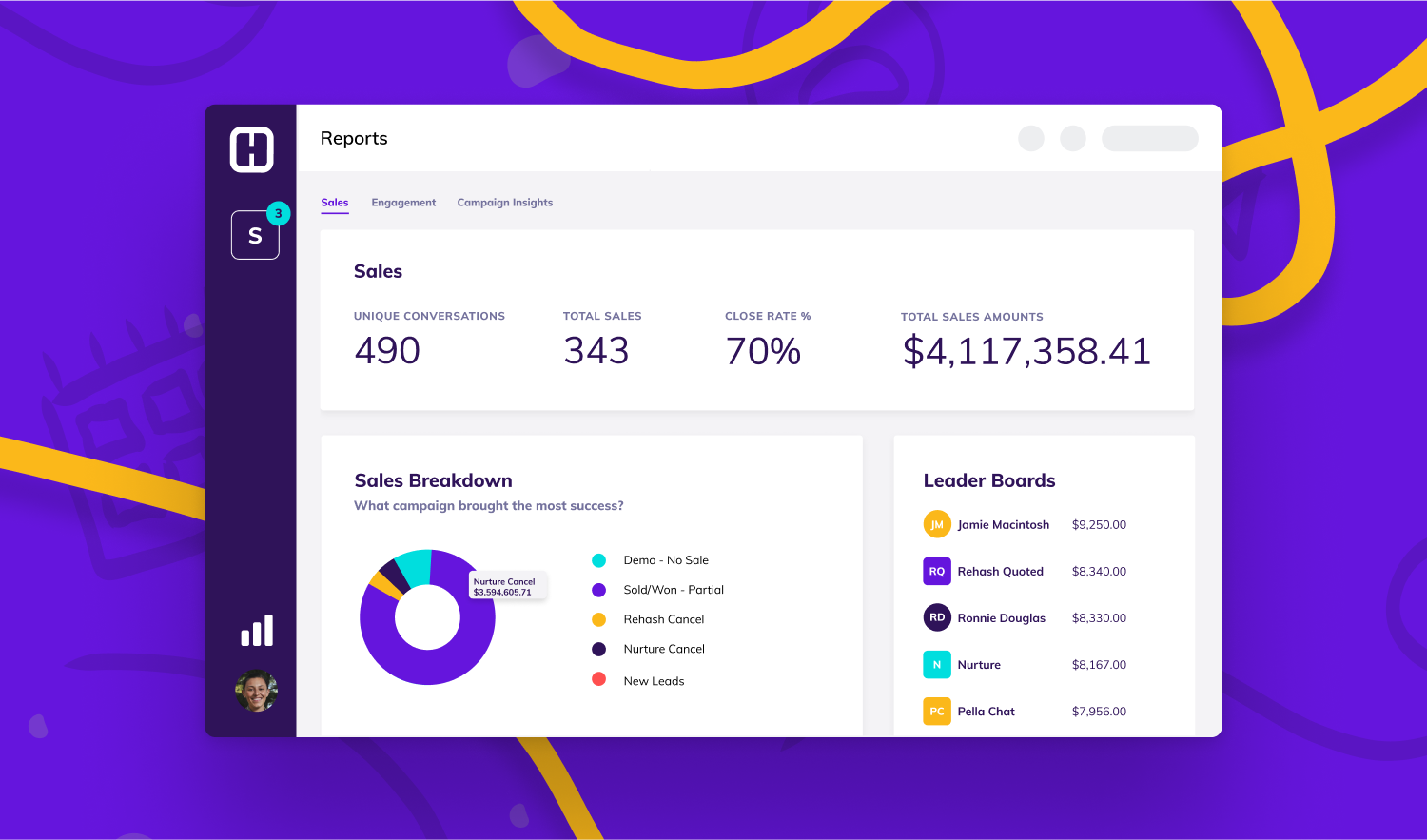

Yelp Inc. to acquire AI lead management startup Hatch for up to $300MJanuary 22 - SiliconANGLE News |

|

Yelp to acquire AI lead management startup Hatch for up to $300MJanuary 22 - SiliconANGLE News |

|

This NYC restaurant just topped Yelp's annual list of 100 places to eat in the U.S.January 22 - Time Out |

|

Yelp Purchasing AI Lead Management Platform Hatch for $300 MillionJanuary 22 - pymnts.com |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q3 '25 | 376M | 36M | 340M | 39M | 71M | 0.960 |

| Q2 '25 | 370M | 35M | 335M | 44M | 71M | 1.070 |

| Q1 '25 | 359M | 35M | 324M | 24M | 45M | 0.810 |

| Q4 '24 | 362M | 33M | 329M | 42M | 69M | 0.990 |

| Q3 '24 | 360M | 32M | 328M | 38M | 60M | 1.020 |

Insider Transactions View All

| Stoppelman Jeremy filed to sell 757,858 shares at $28.7. January 23 '26 |

| Stoppelman Jeremy filed to sell 756,458 shares at $29.2. January 23 '26 |

| Stoppelman Jeremy filed to sell 756,458 shares at $29.3. January 23 '26 |

| Stoppelman Jeremy filed to sell 756,458 shares at $28.1. January 20 '26 |

| Nachman Joseph R filed to sell 188,880 shares at $33.3. January 6 '26 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

MetaMETA |

$672.97 0.1% | 48 |

|

$334.55 0.4% | 53 | |

|

BaiduBIDU |

$157.64 1% | 34 |

|

VeriSignVRSN |

$249.63 0.8% | 38 |

|

SnapSNAP |

$7.46 1.3% | 49 |

Read more about Yelp (YELP) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, app downloads, 4chan mentions, facebook engagement, facebook followers, instagram followers, reddit mentions, stocktwits mentions, stocktwits subscribers, tiktok followers, x followers, x mentions, news mentions, customer reviews, lobbying cost, business outlook & linkedin employees.

FAQ - Yelp

The Market Cap of Yelp is $1.78B.

As of today, Yelp's PE (Price to Earnings) ratio is 12.62.

Currently, the price of one share of Yelp stock is $27.31.

The YELP stock price chart above provides a comprehensive visual representation of Yelp's stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Yelp shares. Our platform offers an up-to-date YELP stock price chart, along with technical data analysis and alternative data insights.

As of our latest update, Yelp (YELP) does not offer dividends to its shareholders. Investors interested in Yelp should consider the potential for capital appreciation as the primary return on investment, rather than expecting dividend payouts.

Some of the similar stocks of Yelp are Meta, Google, Baidu, VeriSign, and Snap.