Alternative Data for Disney

About Disney

Walt Disney Co together with its subsidiaries is a diversified worldwide entertainment company with operations in four business segments: Media Networks, Parks and Resorts, Studio Entertainment, and Consumer Products & Interactive Media.

| Price | $110.61 |

| Target Price | Sign up |

| Volume | 8,910,000 |

| Market Cap | $198B |

| Year Range | $101.25 - $123.17 |

| Dividend Yield | 1.32% |

| PE Ratio | 16.2 |

| Analyst Rating | 78% buy |

| Earnings Date | February 2 '26 |

| Industry | Entertainment |

In the news

|

Disney Revives An Iconic '90s Franchise With A Long-Awaited 2026 ComebackJanuary 27 - Screen Rant |

|

The coolest character in all of Star Wars returns with his own Disney+ show in April — check out the gorgeous 1st trailer (video)January 27 - Space.com |

|

Daredevil: Born Again Season 2 Trailer Reunites Matt Murdock And Jessica Jones — Get Disney+ Premiere DateJanuary 27 - TVLine |

I'm a travel planner who's visited Disney World over 50 times. Here are 10 vacation mistakes I always see people make.January 27 - Business Insider |

|

|

How to Plan a Disney Vacation: What to Know Before You GoJanuary 27 - Disneyparksblog.com |

|

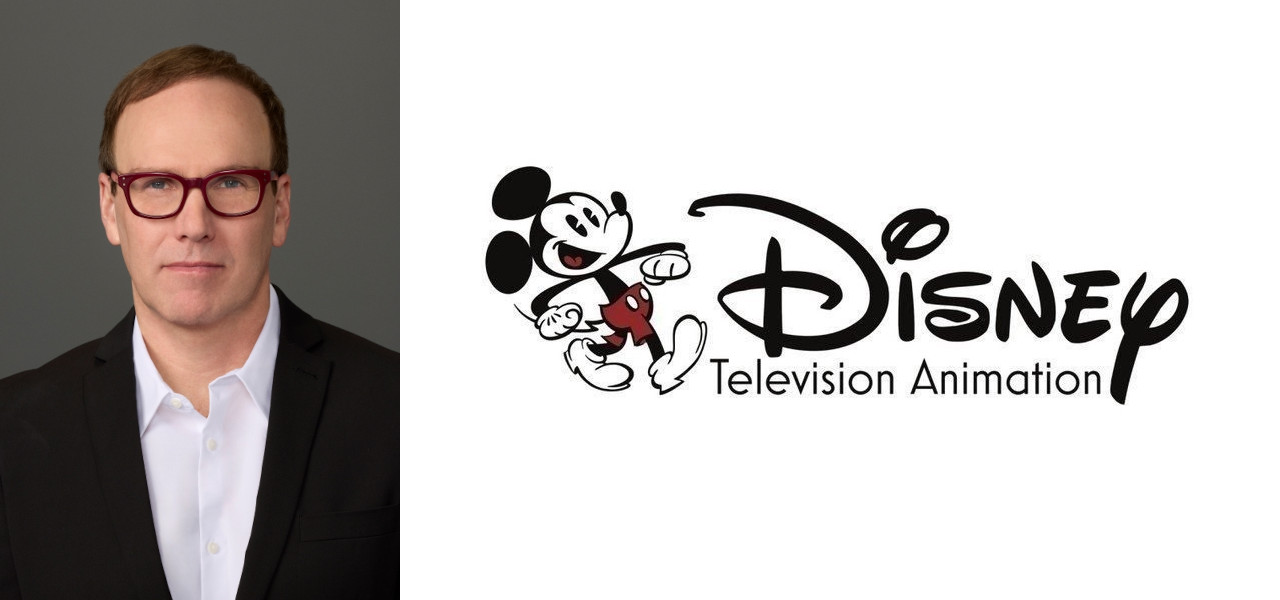

Zack Olin Named SVP Of Development And Current Series At Disney TV AnimationJanuary 27 - Cartoon Brew |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q3 '25 | 22.5B | 14B | 8.45B | 1.31B | 3.95B | 1.110 |

| Q2 '25 | 23.7B | 14.5B | 9.12B | 5.26B | 4.98B | 1.610 |

| Q1 '25 | 23.6B | 14.8B | 8.81B | 3.28B | 4.88B | 1.450 |

| Q4 '24 | 24.7B | 15.4B | 9.28B | 2.55B | 5.42B | 1.760 |

| Q3 '24 | 22.6B | 14.2B | 8.34B | 460M | 2.77B | 1.140 |

Insider Transactions View All

| Coleman Sonia L filed to sell 2 shares at $114. January 23 '26 |

| GORMAN JAMES P filed to buy 38,000 shares at $111.9. December 15 '25 |

| WOODFORD BRENT filed to sell 46,831 shares at $110.8. May 13 '25 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

Live NationLYV |

$146.8 0.7% | 56 |

|

NetflixNFLX |

$85.58 0.1% | 68 |

|

AMCAMC |

$1.45 2.7% | 57 |

|

Fubo TVFUBO |

$2.37 4.4% | 33 |

|

RokuROKU |

$104.58 2.3% | 57 |

Congress Trading View All

| Politician | Filing Date | Type | Size |

|---|---|---|---|

| Nancy Pelosi |

Jan 26, 26 | Sell | $1M - $5M |

| Tony Wied |

Nov 14, 25 | Buy | $100K - $250K |

| Laura Friedman |

Sep 10, 25 | Sell | $1K - $15K |

Read more about Disney (DIS) and their subscribers, ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, app downloads, 4chan mentions, facebook engagement, facebook followers, instagram followers, pinterest followers, reddit mentions, reddit subscribers, stocktwits mentions, stocktwits subscribers, threads followers, tiktok followers, x followers, x mentions, youtube subscribers, news mentions, customer reviews, lobbying cost, business outlook & linkedin employees.

FAQ - Disney

The Market Cap of Disney is $198B.

As of today, Disney's PE (Price to Earnings) ratio is 16.2.

Disney will report its next earnings on February 2 '26.

Currently, the price of one share of Disney stock is $110.61.

The DIS stock price chart above provides a comprehensive visual representation of Disney's stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Disney shares. Our platform offers an up-to-date DIS stock price chart, along with technical data analysis and alternative data insights.

Yes, Disney (DIS) offers dividends to its shareholders, with a dividend yield of 1.32%. This dividend yield represents Disney's commitment to providing value to its shareholders through both potential capital appreciation and steady income. Investors considering Disney in their portfolio should factor in this dividend policy alongside the company's growth prospects and market position.

Some of the similar stocks of Disney are Live Nation, Netflix, AMC, Fubo TV, and Roku.