AI Stock Analysis - Aehr Test Systems (AEHR)

Analysis generated July 14, 2025.

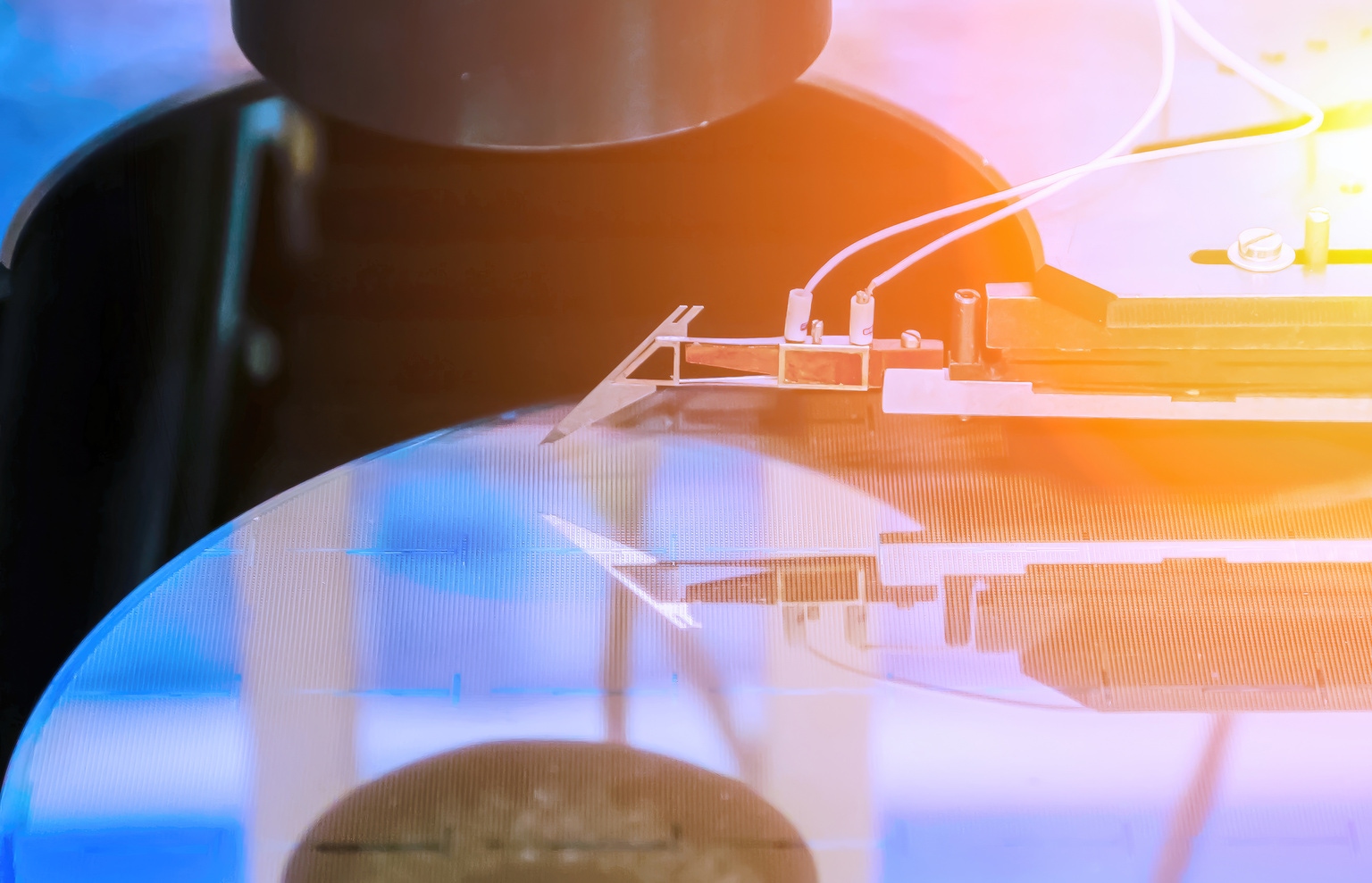

Aehr Test Systems is a global leader in advanced test systems for the semiconductor industry. The company manufactures products designed to reduce the cost of semiconductor manufacturing and improve yield, extending its expertise into wafer-level and singulated die testing. Aehr's market presence spans across multiple segments, including automotive, mobile devices, and integrated components, catering to the high demands for rigorous testing in electronics.

Stock Alerts - Aehr Test Systems (AEHR)

|

Aehr Test Systems | January 27 Insider Alert: OLIPHANT LAURA is selling shares |

|

Aehr Test Systems | January 23 Price is down by -6.2% in the last 24h. |

|

Aehr Test Systems | January 22 Price is up by 7% in the last 24h. |

|

Aehr Test Systems | January 16 Price is up by 7.1% in the last 24h. |

Download our app to get future alerts delivered in real-time.

Alternative Data for Aehr Test Systems

| Alternative Data | Value | 3m Change | Trend | Benchmark |

|---|---|---|---|---|

| Job Posts | 2 | Sign up | Sign up | Sign up |

| Sentiment | 89 | Sign up | Sign up | Sign up |

| Webpage traffic | 6,000 | Sign up | Sign up | Sign up |

| Employee Rating | 86 | Sign up | Sign up | Sign up |

| Google Trends | N/A | Sign up | Sign up | Sign up |

| Patents | N/A | Sign up | Sign up | Sign up |

| 4chan Mentions | N/A | Sign up | Sign up | Sign up |

| Reddit Mentions | N/A | Sign up | Sign up | Sign up |

| Stocktwits Mentions | 24 | Sign up | Sign up | Sign up |

| Stocktwits Subscribers | 11,525 | Sign up | Sign up | Sign up |

| X Mentions | 38 | Sign up | Sign up | Sign up |

| News Mentions | N/A | Sign up | Sign up | Sign up |

| Customer reviews | N/A | Sign up | Sign up | Sign up |

| Business Outlook | 100 | Sign up | Sign up | Sign up |

| Linkedin Employees | 134 | Sign up | Sign up | Sign up |

About Aehr Test Systems

Aehr Test Systems provides test solutions for testing, burning-in, and semiconductor devices in wafer level, singulated die, and package part form, and installed systems worldwide.

| Price | $27.75 |

| Target Price | Sign up |

| Volume | 1,160,000 |

| Market Cap | $859M |

| Year Range | $8.47 - $33.63 |

| Dividend Yield | 0% |

| PE Ratio | 19 |

| Analyst Rating | 100% buy |

| Industry | Semiconductor |

In the news

|

Small Cap Spike: Semi Stock AEHR Up +40% in 2026 Post-EarningsJanuary 21 - Yahoo |

|

Aehr Test Systems price target lowered by $1 at Freedom Capital, here's whyJanuary 13 - Thefly.com |

Aehr Test Systems price target lowered to $21 from $24 at Craig-HallumJanuary 10 - Yahoo Entertainment |

|

|

Aehr Test Systems price target lowered by $3 at Craig-Hallum, here's whyJanuary 9 - Thefly.com |

|

Aehr Test Systems: Big Forecasts, More Proof NeededJanuary 8 - SeekingAlpha |

Aehr Test Systems Q2 Earnings Call HighlightsJanuary 8 - Yahoo Entertainment |

|

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q4 '25 | 9.9M | 7.3M | 2.5M | -3.2M | -4.4M | -0.040 |

| Q3 '25 | 11M | 7.3M | 3.7M | -2.1M | -2.9M | 0.010 |

| Q2 '25 | 14M | 9.8M | 4.3M | -2.9M | -2M | -0.010 |

| Q1 '25 | 18M | 11M | 7.2M | -640,000 | 35,000 | 0.070 |

| Q4 '24 | 13M | 8.1M | 5.4M | -1M | -350,000 | 0.020 |

Insider Transactions View All

| OLIPHANT LAURA filed to sell 18,572 shares at $31.5. January 26 '26 |

| OLIPHANT LAURA filed to sell 18,852 shares at $31.4. January 26 '26 |

| OLIPHANT LAURA filed to sell 18,432 shares at $31.5. January 26 '26 |

| OLIPHANT LAURA filed to sell 18,672 shares at $31.5. January 26 '26 |

| OLIPHANT LAURA filed to sell 19,878 shares at $31.4. January 26 '26 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

AMDAMD |

$252.03 0.3% | 51 |

|

IntelINTC |

$43.93 3.4% | 42 |

|

Microchip TechnologyMCHP |

$75.16 0.5% | 43 |

|

NVIDIANVDA |

$188.52 1.2% | 70 |

|

Texas InstrumentsTXN |

$196.63 0% | 51 |

Read more about Aehr Test Systems (AEHR) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, 4chan mentions, reddit mentions, stocktwits mentions, stocktwits subscribers, x mentions, news mentions, customer reviews, business outlook & linkedin employees.

FAQ - Aehr Test Systems

The Market Cap of Aehr Test Systems is $859M.

As of today, Aehr Test Systems' PE (Price to Earnings) ratio is 19.

Currently, the price of one share of Aehr Test Systems stock is $27.75.

The AEHR stock price chart above provides a comprehensive visual representation of Aehr Test Systems' stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Aehr Test Systems shares. Our platform offers an up-to-date AEHR stock price chart, along with technical data analysis and alternative data insights.

As of our latest update, Aehr Test Systems (AEHR) does not offer dividends to its shareholders. Investors interested in Aehr Test Systems should consider the potential for capital appreciation as the primary return on investment, rather than expecting dividend payouts.

Some of the similar stocks of Aehr Test Systems are AMD, Intel, Microchip Technology, NVIDIA, and Texas Instruments.